In the realm of personal finance, the concept of credit often evokes mixed emotions. For some, it’s synonymous with debt and financial struggle, while for others, it represents opportunities for growth and wealth accumulation. However, regardless of one’s initial perception, credit serves as the cornerstone of wealth building for individuals and families alike. In this blog post, we’ll explore why credit is not just a financial tool but also the beginning of a journey towards prosperity.

Understanding Credit

First and foremost, let’s define what credit is. In simple terms, credit is the ability to borrow money or access goods and services with the promise of repayment in the future. It’s a financial resource that allows individuals to make purchases, invest in opportunities, and achieve important milestones such as homeownership or entrepreneurship.

Understanding credit entails grasping its nuances beyond simple borrowing. It involves comprehending how credit utilization affects credit scores, the significance of responsible repayment habits, and the impact of credit inquiries on one’s financial profile. Moreover, understanding the various types of credit available, such as revolving credit (e.g., credit cards) and installment credit (e.g., loans), allows individuals to make informed decisions about their financial health. Additionally, understanding the terms and conditions of credit agreements, including interest rates, fees, and repayment schedules, is vital for making prudent financial choices and maximizing the benefits of credit.

Leveraging Opportunities

One of the primary reasons why credit is the beginning of wealth is its ability to unlock opportunities. Whether it’s obtaining a mortgage to purchase a home, securing a business loan to start a venture, or investing in education to enhance earning potential, credit provides the initial capital needed to pursue these endeavors. Without access to credit, many individuals would struggle to afford these opportunities and consequently miss out on the potential for long-term wealth accumulation.

Leveraging opportunities through credit involves seizing strategic moments to enhance one’s financial situation. This may include utilizing credit to invest in income-generating assets like real estate or stocks, funding educational pursuits to expand career prospects, or seizing entrepreneurial ventures that require upfront capital. By leveraging credit wisely, individuals can capitalize on opportunities that have the potential to yield significant returns, propel career advancement, and accelerate wealth accumulation. Additionally, leveraging credit allows individuals to take calculated risks that can lead to long-term financial prosperity, while also diversifying their portfolio and expanding their financial horizons.

Building a Strong Financial Foundation

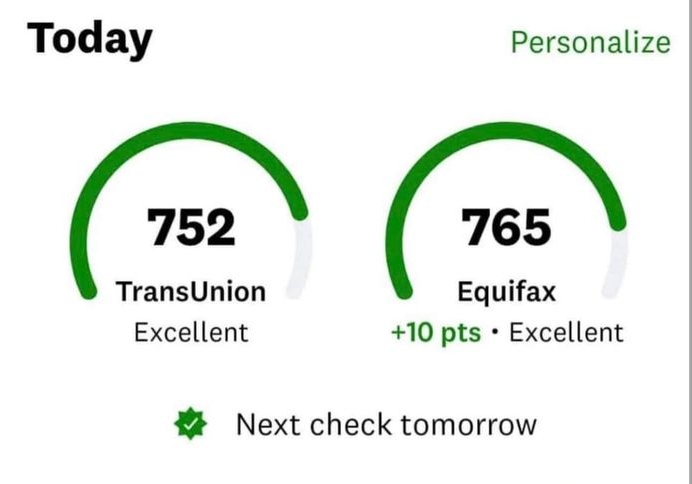

Credit also plays a crucial role in building a strong financial foundation. By responsibly managing credit accounts, individuals can establish a positive credit history and improve their credit score. A good credit score opens doors to better interest rates on loans and credit cards, lower insurance premiums, and even favorable terms on rental agreements. These financial advantages translate into significant savings over time, allowing individuals to allocate more resources towards wealth-building activities such as savings, investments, and retirement planning.

Building a strong financial foundation through credit involves establishing a solid framework for long-term financial stability and success. This includes responsibly managing credit accounts to cultivate a positive credit history and improve credit scores. With a strong credit foundation, individuals can access favorable loan terms, lower interest rates, and higher credit limits, enabling them to make informed financial decisions and achieve their goals more efficiently. Additionally, a strong credit foundation provides a sense of financial security and empowerment, allowing individuals to navigate life’s challenges with confidence and resilience, ultimately laying the groundwork for a prosperous financial future.

Realizing Financial Goals

Moreover, credit serves as a catalyst for achieving financial goals. Whether it’s purchasing a dream home, starting a business, or traveling the world, credit provides the means to turn aspirations into reality. By strategically leveraging credit, individuals can accelerate their progress towards these goals, taking advantage of opportunities that may otherwise be out of reach. From financing a college education to funding a once-in-a-lifetime investment opportunity, credit empowers individuals to pursue their dreams and build wealth along the way.

Realizing financial goals through credit involves using available credit resources strategically to turn aspirations into tangible achievements. Whether it’s purchasing a home, starting a business, or pursuing higher education, credit provides the necessary funding to make these dreams a reality. By leveraging credit responsibly, individuals can expedite the attainment of their financial objectives, seizing opportunities that may otherwise be out of reach. Moreover, utilizing credit to realize financial goals fosters a sense of accomplishment and fulfillment, empowering individuals to take control of their financial destiny and create a brighter future for themselves and their loved ones.

Creating Wealth-Building Assets

Another reason why credit is the beginning of wealth lies in its ability to create wealth-building assets. For example, taking out a mortgage to buy real estate can result in property appreciation and rental income, ultimately leading to long-term wealth accumulation. Similarly, borrowing money to invest in stocks, bonds, or other financial instruments can generate passive income and capital gains over time. By strategically using credit to acquire income-producing assets, individuals can build wealth steadily and diversify their financial portfolio.

Creating wealth-building assets through credit involves strategically using borrowed funds to acquire assets that appreciate in value or generate passive income over time. This may include investing in real estate properties, purchasing stocks or other financial instruments, or funding business ventures. By leveraging credit to acquire income-producing assets, individuals can build wealth steadily and diversify their financial portfolio. Over time, these assets have the potential to generate significant returns, increase net worth, and create long-term financial security. Moreover, creating wealth-building assets through credit fosters financial independence and paves the way for generational wealth accumulation.

Managing Risk and Uncertainty

Additionally, credit serves as a valuable tool for managing risk and uncertainty. Life is full of unexpected challenges, ranging from medical emergencies to job loss and natural disasters. Having access to credit provides a safety net during difficult times, allowing individuals to cover essential expenses, maintain their standard of living, and weather financial storms without resorting to drastic measures. Furthermore, credit can also serve as a bridge during transitional periods, such as career changes or business setbacks, providing the flexibility needed to navigate uncertain terrain.

Managing risk and uncertainty through credit involves utilizing credit as a safety net during unpredictable circumstances. This may include using credit to cover essential expenses during times of job loss, medical emergencies, or natural disasters. By having access to credit, individuals can mitigate financial hardship, maintain their standard of living, and navigate through challenging times with greater resilience. Moreover, credit can serve as a bridge during transitional periods, such as career changes or business setbacks, providing the flexibility needed to adapt to changing circumstances and regain financial stability.

Conclusion

In conclusion, credit is much more than just a financial instrument—it’s the foundation upon which wealth building begins. By leveraging credit responsibly, individuals can unlock opportunities, build a strong financial foundation, realize their goals, create wealth-building assets, and manage risk and uncertainty effectively. Whether it’s purchasing a home, starting a business, or investing for the future, credit empowers individuals to take control of their financial destiny and embark on a journey towards prosperity. Therefore, understanding the importance of credit and utilizing it wisely is essential for anyone seeking to build wealth and achieve financial success in the long run.

E & S Direct LLC

P.S. Take control of your financial future today with our credit repair services. Say goodbye to high interest rates, loan rejections, and financial stress. With choice (1) MyNovaeDisputes, AI generated letters to the credit bureaus that you mail off, or choice (2) Credit Likes, everything done for you and after 6 months if no results you get your money back. Don’t let past mistakes hold you back—invest in your future with our proven credit repair solutions. Contact us now to get started on the path to financial freedom!