Bankruptcy feels like the end.

For many entrepreneurs, it’s one of the hardest moments of their lives—not just financially, but emotionally. It can feel like failure. Like everything you worked for disappeared overnight. Like you’re starting over while everyone else is moving forward.

But here’s the truth most people won’t tell you:

Bankruptcy isn’t the end of your story.

For many entrepreneurs, it’s the restart button.

I’ve worked with business owners who thought bankruptcy permanently disqualified them from funding, credibility, and growth. Some were embarrassed. Some were angry. Many were scared to even look at their credit reports.

And yet, I’ve watched those same entrepreneurs rebuild—slowly, intentionally—and come back stronger than before.

Not because they found a shortcut.

Not because they gamed the system.

But because they followed a disciplined plan and stopped letting shame drive their decisions.

This post is for the entrepreneur who’s been there—or might be there right now—and needs clarity, not judgment.

The Emotional Reality of Bankruptcy as an Entrepreneur

Let’s start with what doesn’t get talked about enough.

Bankruptcy doesn’t just affect your finances—it affects your identity.

Entrepreneurs often tie their self-worth to their business. When the business collapses, it can feel personal. You replay every decision. Every risk. Every “what if.”

You may feel:

- Ashamed to talk about money

- Afraid to apply for anything financial

- Convinced lenders will always see you as “high risk”

- Tempted to chase quick fixes to make the pain go away

This emotional weight is dangerous—not because it’s wrong to feel it, but because it can push you into bad decisions.

I’ve seen entrepreneurs:

- Avoid rebuilding entirely because it feels overwhelming

- Fall for “instant credit fix” promises

- Stack risky products too fast

- Give up on funding before they’re actually disqualified

Here’s what matters most after bankruptcy:

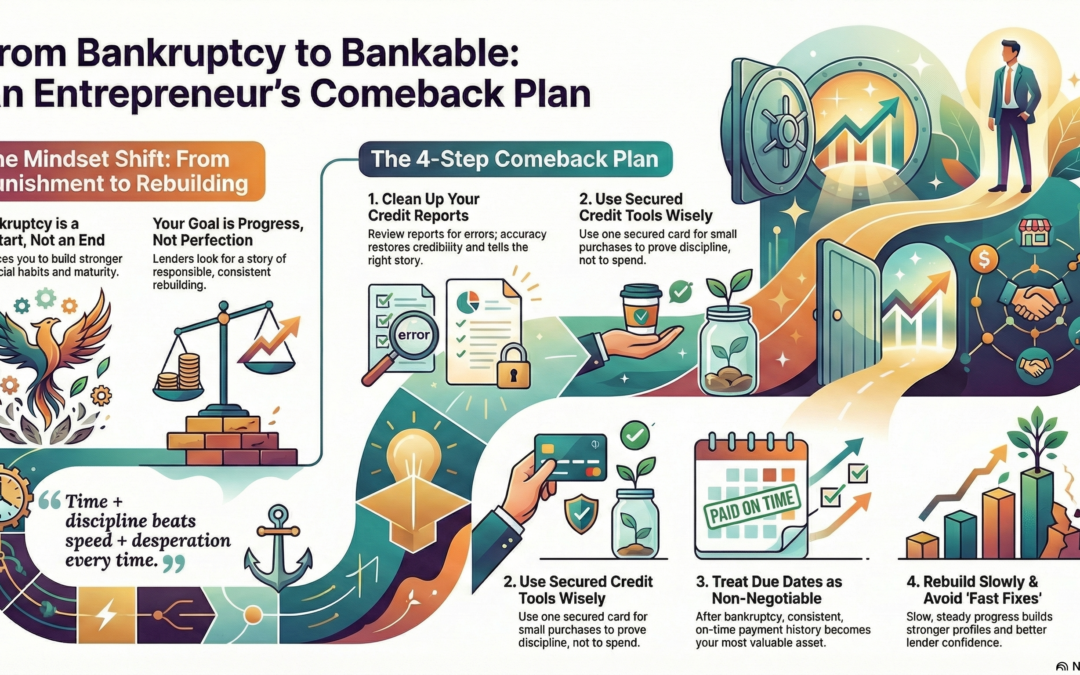

Your mindset has to shift from punishment to rebuilding.

Bankruptcy doesn’t mean you’re irresponsible.

It means something didn’t work—and now you have data.

Why Bankruptcy Can Actually Strengthen Your Financial Foundation

This might sound counterintuitive, but hear me out.

Entrepreneurs who rebuild after bankruptcy often end up with better financial habits than those who never hit that wall.

Why?

Because bankruptcy forces you to confront:

- Cash flow discipline

- Debt management

- Credit structure

- Emotional spending decisions

- The difference between growth and overextension

When rebuilding is done correctly, you don’t just restore your credit—you rebuild financial maturity.

And lenders notice that.

A post-bankruptcy borrower with clean, consistent behavior is often more attractive than someone with a “perfect” score built on shaky habits.

The Post-Bankruptcy Comeback Plan (What Actually Works)

There’s no magic timeline, but there is a proven process.

Step 1: Clean Up Your Credit Reports and Correct Errors

After bankruptcy, your first job is accuracy—not perfection.

Pull all three credit reports and review them line by line.

Look for:

- Accounts that should be included in bankruptcy but still show balances

- Incorrect dates

- Duplicate listings

- Accounts reporting “late” after the discharge date

This step alone can make a meaningful difference.

Why it matters:

- Lenders don’t just look at your score—they look at your report

- Errors make you look riskier than you are

- Accuracy restores credibility

This is about telling the right story on paper.

Step 2: Use Secured Credit Tools Responsibly

Secured credit cards are one of the most effective rebuilding tools—but only when used correctly.

The goal is not access to spending.

The goal is proof of discipline.

Best practices:

- Start with one secured card

- Use it lightly (small purchases)

- Keep utilization low

- Pay it on time, every time

You’re not trying to “build fast.”

You’re trying to build trust.

Lenders care far more about consistent, on-time behavior than how much credit you have.

Step 3: Treat Every Due Date Like a Non-Negotiable Business Meeting

This step is simple—but powerful.

After bankruptcy, payment history becomes everything.

Missed or late payments hurt more during rebuilding because:

- You’re under closer scrutiny

- Patterns matter more than individual events

- One mistake can slow progress significantly

Successful rebuilders do one thing consistently:

They treat due dates like appointments that cannot be missed.

Set reminders.

Automate payments.

Build systems—not memory.

This isn’t about perfection.

It’s about consistency.

Step 4: Rebuild Slowly Instead of Chasing “Fast Fixes”

This is where many entrepreneurs sabotage themselves.

After bankruptcy, the temptation is strong to:

- Add too many accounts too quickly

- Accept high-fee products

- Jump at offers that promise speed

But rebuilding credit is not a sprint.

Slow, steady progress creates:

- Stronger profiles

- Better lender confidence

- Fewer setbacks

Remember:

Time + discipline beats speed + desperation every time.

Why “Fast Credit Fixes” Usually Backfire

When someone feels desperate, they become vulnerable to promises.

Be cautious of anyone who claims they can:

- Remove accurate negative information

- Guarantee specific score increases

- Deliver instant approvals

Those tactics often create:

- Legal risk

- Additional financial damage

- Long-term setbacks

Real rebuilding is boring—and that’s why it works.

From “I’ll Never Recover” to Funding Again

I’ve watched entrepreneurs go from:

“I’ll never recover from this.”

To:

“I just got approved again.”

Not because the system changed—but because they did.

They stopped hiding.

They stopped rushing.

They followed a plan.

And when they applied again, their story made sense:

- Bankruptcy addressed the past

- Clean payment history showed responsibility

- Structured rebuilding demonstrated growth

Lenders don’t expect perfection.

They expect progress.

Your Past Doesn’t Disqualify Your Future

Let me say this clearly:

Bankruptcy does not disqualify you from entrepreneurship.

It does not disqualify you from funding.

It does not disqualify you from success.

What disqualifies people is giving up—or refusing to learn.

If you’re willing to:

- Face the numbers

- Build discipline

- Rebuild intentionally

You can create a stronger foundation than you ever had before.

Final Thoughts: The Restart Button

Bankruptcy feels like the end.

But for many entrepreneurs, it’s actually the restart button.

The comeback plan usually looks like this:

1️⃣ Cleaning up reports and correcting errors

2️⃣ Using tools like secured cards responsibly

3️⃣ Treating every due date like a non-negotiable business meeting

4️⃣ Rebuilding slowly instead of chasing “fast fixes”

I’ve seen people go from “I’ll never recover” to qualifying for funding again—because they followed a plan instead of living in shame.

Your past doesn’t disqualify your future… if you’re willing to do the work.

And if you are—that future is still very much on the table.

E & S Direct LLC