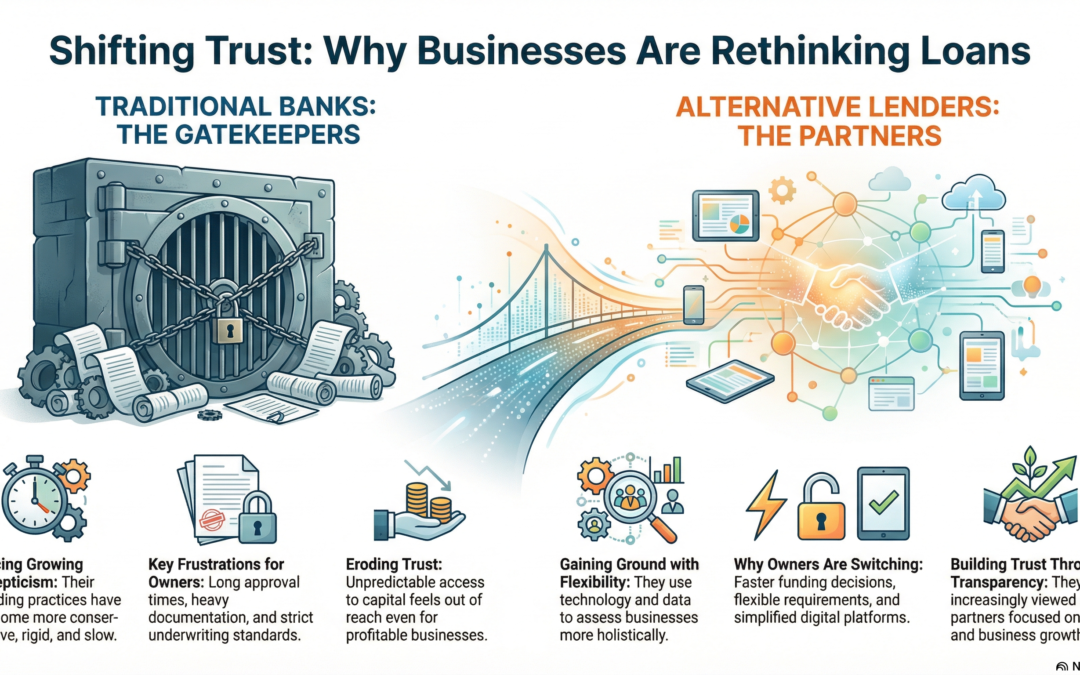

Trust in financial institutions has always played a major role in how businesses access capital. For decades, traditional banks were the primary gatekeepers for loans, lines of credit, and long-term financing. Today, that trust is shifting—and many business owners are rethinking where they turn for funding.

This change isn’t happening by accident. It’s the result of evolving economic conditions, tighter lending standards, and the rise of new financing options designed specifically for modern entrepreneurs.

Growing Skepticism Toward Traditional Banks

Traditional banks are facing increased scrutiny from business owners, especially small and mid-sized companies. While banks are often seen as stable and secure, their lending practices have become more conservative.

Entrepreneurs frequently cite:

- Longer approval timelines

- Increased documentation requirements

- Stricter underwriting standards

- Limited flexibility for newer or nontraditional businesses

For many owners, this creates frustration. Even profitable businesses can struggle to qualify if they don’t fit neatly into a bank’s risk model. As a result, trust erodes when access to capital feels unpredictable or out of reach.

Why Alternative Lenders Are Gaining Ground

As banks tighten their criteria, alternative lenders and fintech platforms are filling the gap. These lenders approach funding differently, often using technology and data-driven models to assess businesses more holistically.

Key reasons business owners are turning to alternatives include:

- Faster application and funding decisions

- More flexible qualification requirements

- Products tailored to cash flow and growth stages

- Digital platforms that simplify the borrowing process

Rather than relying solely on traditional credit metrics, many alternative lenders focus on how a business operates today—not just how it looked on paper years ago.

Trust Is About More Than Interest Rates

While rates and terms matter, trust is built on transparency, communication, and alignment. Business owners want to understand:

- What they qualify for before applying

- How decisions are made

- What steps they can take to improve future approvals

When lenders provide clarity and guidance instead of confusion and delays, confidence grows. That’s one of the reasons alternative lenders are increasingly viewed as partners rather than gatekeepers.

Choosing the Right Path Forward

The shift in trust doesn’t mean banks are becoming irrelevant. For some businesses, especially those with long operating histories and strong balance sheets, banks remain a valuable option. For others, alternative lenders offer accessibility and speed that better match their needs.

The smartest approach isn’t choosing sides—it’s understanding your business profile, your goals, and which funding source aligns with both.

In today’s environment, informed entrepreneurs don’t just look for capital. They look for clarity, flexibility, and financial partners they can trust.

The Rise of Alternative Lenders and Fintech

As banks pull back, alternative lenders have moved in with a different approach.

What’s attracting business owners?

-

Faster funding decisions

-

More flexible credit models

-

Technology-driven platforms that reduce friction

-

A stronger focus on cash flow, real-world performance, and growth potential

For many entrepreneurs, these options feel more aligned with how business actually works today—especially in fast-moving or nontraditional industries.

It’s Not Just About Rates—It’s About Confidence

Trust goes beyond interest rates and loan terms. It’s about:

-

Feeling understood as a business owner

-

Transparency in the process

-

Knowing where you stand before you apply

-

Working with partners who want to see you grow, not just check boxes

That’s why this conversation matters. Where you place your trust often determines how confidently—and how quickly—you can move forward.

Final Thoughts

The way business owners think about trust in lending is changing. Traditional banks still play an important role, but they’re no longer the only—or automatic—choice. Alternative lenders have earned attention by offering speed, flexibility, and a clearer understanding of how modern businesses operate.

The key takeaway is this: trust isn’t about labels, it’s about alignment. The right lender is the one that understands your business, communicates transparently, and supports your growth goals. When entrepreneurs focus on education and readiness instead of assumptions, they put themselves in position to access capital with confidence—no matter which path they choose.

E & S Direct LLC